what does cares act do

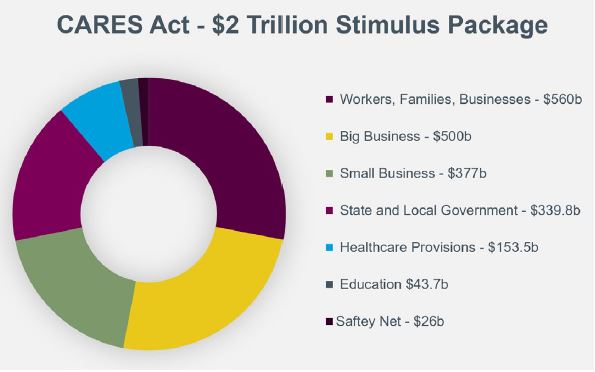

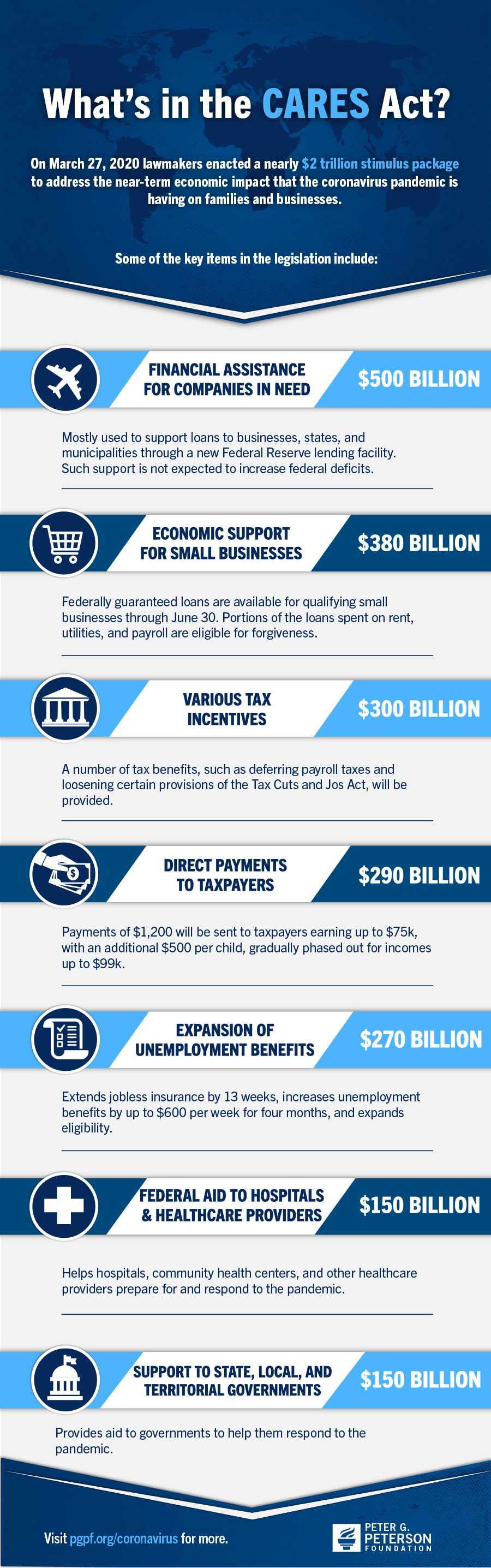

Its components include stimulus payments to individuals expanded unemployment coverage and more. As soon as everything began shutting down in an effort to slow the spread of COVID-19 the economy started to take a big hit.

What Is Obamacare What Is The Affordable Care Act

Second the CARES Act provides funds to federal agencies in order to reimburse federal contractors for paid leave that they provided to certain employees or subcontractors.

. 1 2021 and in the case of a taxable year beginning after Dec. The Affordable Care Act implemented reforms to the health insurance market. The CARES act affects retirement accounts such as 401 k accounts by lifting penalties for early withdrawal.

The CARES Act creates a new type of loan for the United States Small Business Administration the SBA to administer. So President Trump signed. The CARES Act does not however generally prohibit taxpayers from using an NOL from a tax year with a lower.

To make the health insurance plans affordable to all the people. What does the CARES Act Do. Read more about CARES act 401k.

What Is the CARES Act. The Care Act helps to improve peoples independence and wellbeing. The CARES Act initially set forbearance protection to expire on Dec.

The COVID-19 economic relief thru the CARES act 401k withdrawal allows families to take advantage of their retirement savings. How do I claim a 1099-R from a Cares Act 401k withdrawal. Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation PEUC.

The bill provides federal aid to. The law has three main goals. It makes clear that local authorities must provide or arrange services that help prevent people developing needs for care.

The Affordable Care Act addresses the following topics in detail each topic is a title which contains sections of provisions that reform our health care system. The CARES Act passed in 2020 had aid for families and businesses. This help ranged from paycheck protection to unemployment aid to tax breaks for companies.

The CARES Act retroactively eliminates the 80 percent limitation for taxable years beginning before Jan. Employees affected by the coronavirus who have 401 k. However the program has since been extended to March 31 2021 and more recently extended.

Unlike the disaster loans currently available through.

Cares Act And K 12 Education What Does It Mean For Wisconsin Maciver Institute

Does The Cares Act Present A Funding Threat To Higher Education Illinois Channel

Avoid Foreclosure Illegal Mortgage Fees Bad Credit Covid Phillips Garcia P C

Cares Act Webinar Series 04 02 20 Youtube

Coronavirus Covid 19 Cares Act Bankruptcy Changes 𝗢𝗮𝗸𝗧𝗿𝗲𝗲 𝗟𝗮𝘄

What The Cares Act Means For Student Veterans Service Members And Their Families Student Veterans Of America

Cares Act What Does It Mean For You Mariner Wealth Advisors

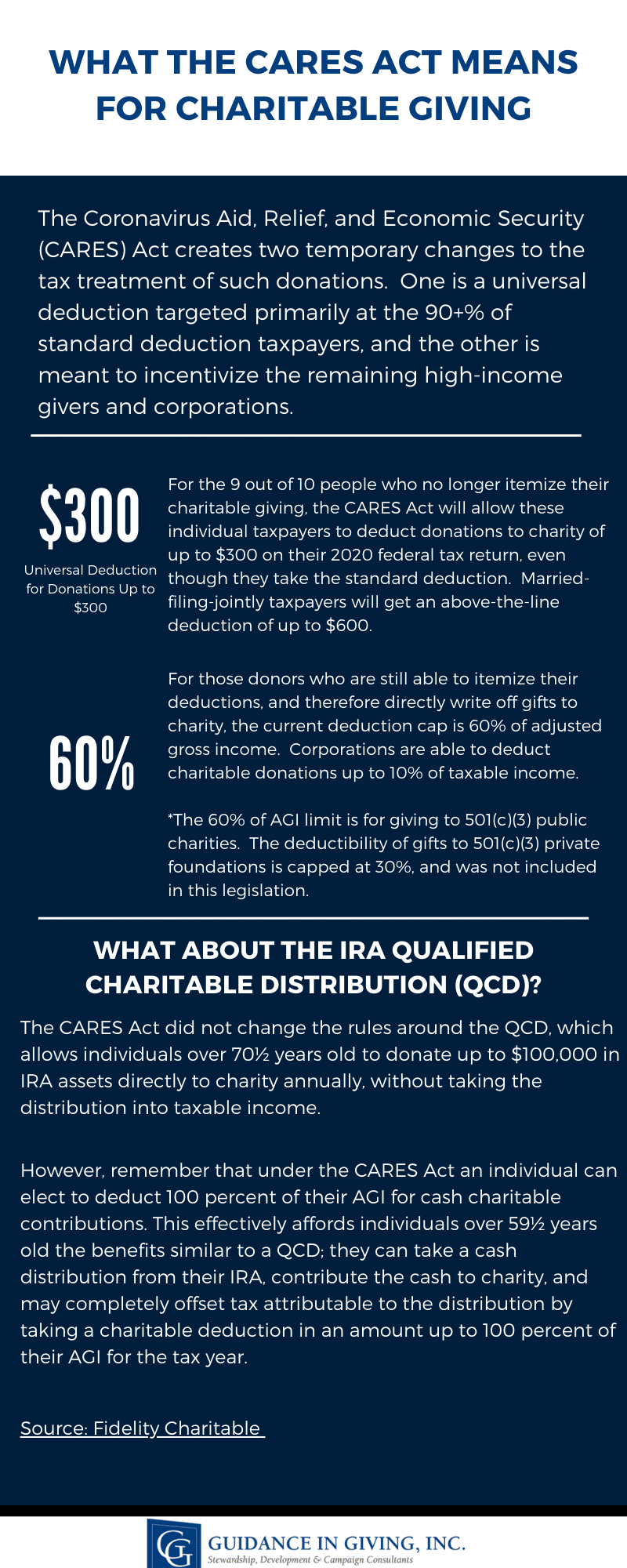

What Does The Cares Act Mean For Charitable Giving Guidance In Giving

How Does The Cares Act Impact My Employee Benefit Plans Lp

What Does The Cares Act Do For You Shannon May Real Estate Moscow Idaho

Rep Cline Statement On H R 748 The Cares Act Congressman Ben Cline

Cares Act 2021 Tax Incentives Aopa

What S In The Cares Act Here S A Summary

What Does The Affordable Care Act Have To Do With Tax Reform The Individual Mandate Goes Away In 2019

What Does The Cares Act Mean For Me Covid 19 Medsphere

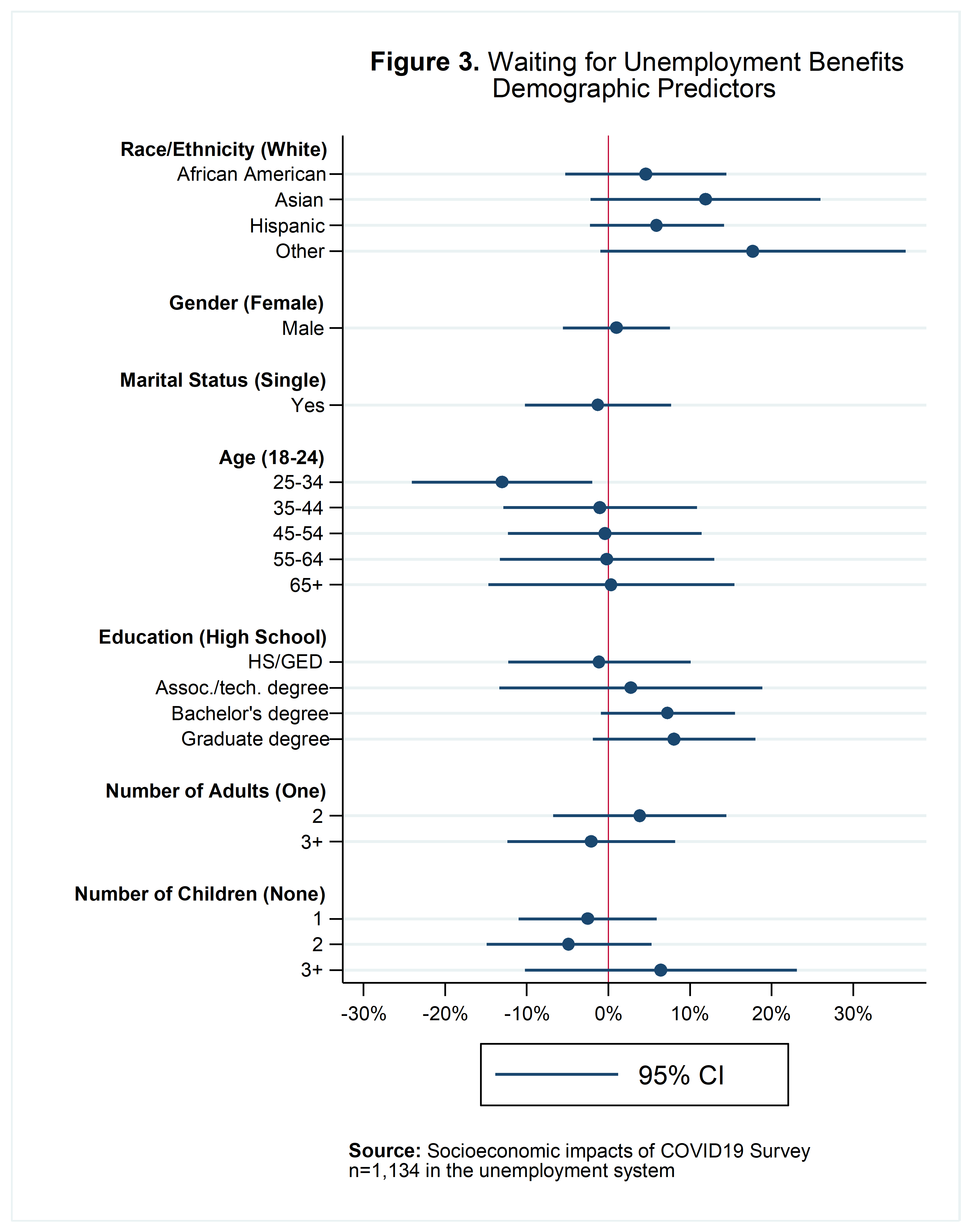

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

The Cares Act What Does It Mean For Financial Institutions Publications Vedder Thinking Vedder Price